The most important rules and regulations to help you manage your GST/HST and maximize recoveries.

The most important rules and regulations to help you manage your GST/HST and maximize recoveries.

Did you know that GST/HST rules for charities are different than those for NPOs?

Do you wonder if you have missed claiming back all eligible GST/HST amounts?

Would you like to learn how to avoid the most common GST/HST errors?

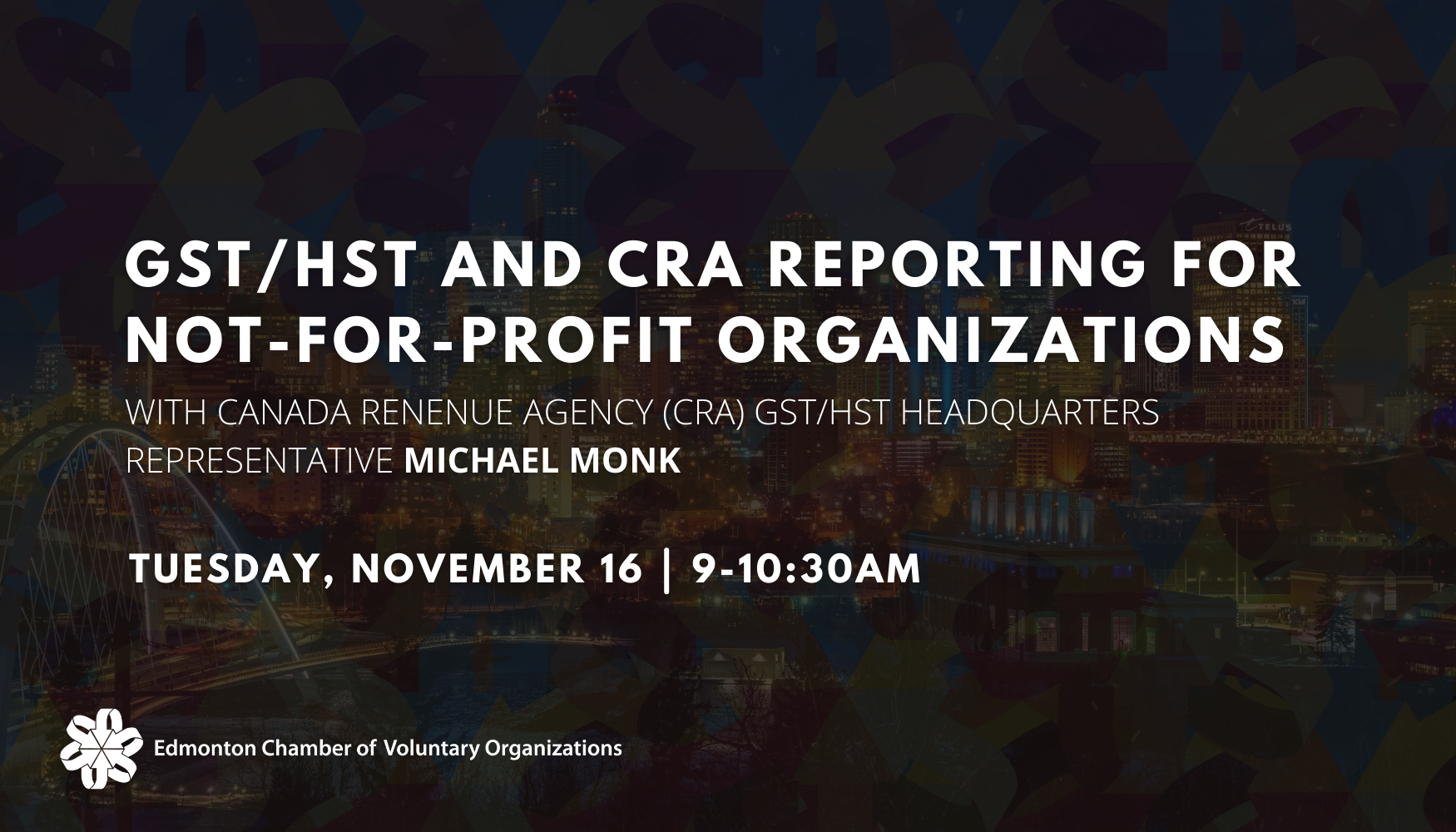

If so, you should attend CRA’s GST/HST Outreach presentation. You will hear directly from CRA’s GST/HST Headquarters representative who has 30+ years experience in GST/HST programs. The presentation will focus on important GST/HST obligations and entitlements. You will learn about rebates, input tax credits and other important GST/HST topics. We will review the most important GST/HST rules and legislation to help you manage your GST/HST and maximize recoveries.

Please note: this webinar will NOT be recorded, however a slideshow will be provided to attendees after the event.

LEARNING OBJECTIVES

- Recognize key GST/HST differences between charities and NPOs

- Know when to charge GST or HST

- Understand basic PSB Rebate rules

- Apply the correct rules for claiming input tax credits

- Identify and reduce common GST/HST mistakes

TOPICS INCLUDE

- Definitions

- Public Service Bodies (PSB) Rebate

- Taxable vs. Exempt Supplies

- Input Tax Credits

- Capital Real Property and Capital Personal Property

- GST/HST Registration and Small Supplier

WHO WILL BENEFIT

This presentation is intended for both charities and NPOs. It is designed for Directors, staff and any other individuals who may be involved in the organization’s GST/HST. Even if you are not currently GST/HST registered, or you think that your entity is “too small” you should still attend. You will learn about ways to maximize your GST/HST recoveries. Finally, if you would just like a refresher or to simply hear directly from CRA that you are “doing things right”, this presentation is for you.

SPEAKER

Michael Monk has been an employee of Canada Revenue Agency (CRA) for more than 30 years. During that time he has worked extensively with GST/HST. Michael spent 10 years with GST/HST Rulings in the Legislative Policy and Regulatory Affairs Branch and several more years in Compliance Programs Branch. He has had several roles in CRA’s Headquarters (HQ), Regional and Tax Services Offices. Michael has also spent several years as a CRA Facilitator, teaching various GST/HST legislation courses to CRA staff.

Michael currently works in Headquarters, GST/HST Directorate, where he has managed CRA’s national GST/HST Outreach Program for the last 4 years. Michael has many years experience working with GST/HST issues in the public sectors. He has participated in several Conferences, preparing and delivering GST/HST presentations to accounting and industry associations.

Michael has volunteered with several community groups over the years, including serving on the Board of Directors for a large national charity and serving on CRA’s Employee Assistance Program.

CONTACT US

If you have any questions regarding this program, please email us at kerry-ann@ecvo.ca.